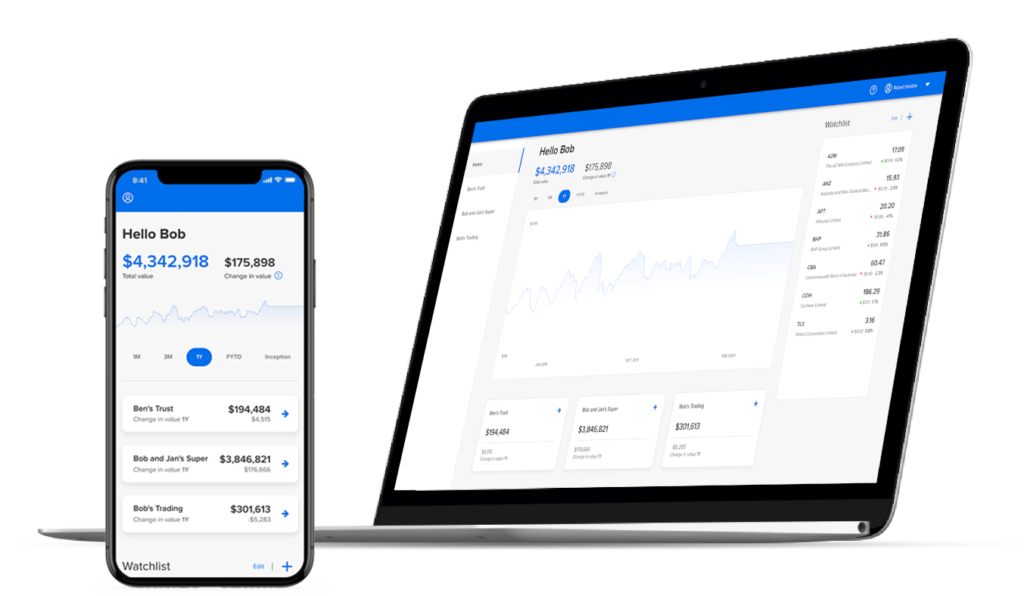

HUBconnect Adviser

Integrate and organise client data and deliver your clients a personalised view of their investments

HUBconnect Adviser is a beautifully simple app designed for advisers like you to bring your clients’ investments together, integrating custodial and non-custodial data to create a single, personalised view of your clients’ investments that they can relate to.

HUBconnect Adviser enables you to:

Connect directly with account providers

Use your adviser credentials to consolidate clients’ investment data – integrating custodial and non-custodial data together with data held with selected brokers.

Organise data in a way that works for you

Customise your data in a way that works for you, in the language your clients’ understand.

Enhance you clients digital experiance

Engage your clients with HUBconnect’s personalised, branded app.

Securing your data

We understand the importance of keeping your client data secure. By leveraging the latest technology to connect securely to other providers, your client data is delivered to you in a format that works for you. Our commitment to data security is demonstrated by our adherence to the internationally recognised ISO 27001 cyber security standards.

About HUBconnect Adviser

Using your login details and secure connections via APIs, you can consolidate your clients’ investment data into a single view, organise it in the language your clients understand, and invite your clients to view their consolidated portfolio details.

Customise the experience

Provide a unique branded experience for your clients, with your logo and branding elements integrated into the app and browser experiences, allowing you to own your advice offering, end to end.

Latest insights

Access to quality data is critical when it comes to improving wealth businesses. Data can help to drive operational efficiencies, manage risk and provide engaging personalised experiences for clients. It can also drive solutions that help bridge the gap with Millennial and Generation Z clients – those who are digital natives and expect frictionless online experiences from their service providers.

Access to quality data is critical when it comes to improving wealth businesses. Data can help to drive operational efficiencies, manage risk and provide engaging personalised experiences for clients. It can also drive solutions that help bridge the gap with Millennial and Generation Z clients – those who are digital natives and expect frictionless online experiences from their service providers.

Harnessing data to solve challenges in the wealth management industry is set to take centre stage over the next few years and beyond as we collaborate to make wealth management more efficient, more accessible and more cost-effective.

Harnessing data to solve challenges in the wealth management industry is set to take centre stage over the next few years and beyond as we collaborate to make wealth management more efficient, more accessible and more cost-effective.

Watch leading tech experts and innovators Dr Charlotte Marra (Google), Daniel Teper (KPMG), and futurist Rocky Scopelliti explore how innovation, data and tech will impact the advice industry.

Watch leading tech experts and innovators Dr Charlotte Marra (Google), Daniel Teper (KPMG), and futurist Rocky Scopelliti explore how innovation, data and tech will impact the advice industry.